1 in 140 People in the World Is Now a Millionaire

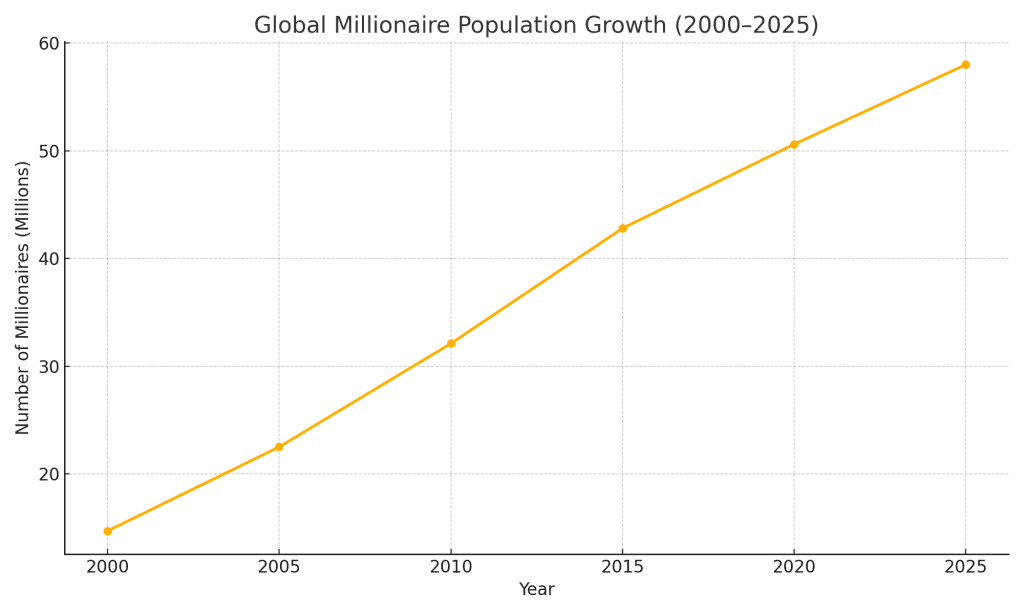

You’ve probably heard someone say, “It’s easier to become a millionaire today than ever before.” But now, for the first time in history, that isn’t just motivational fluff — it’s statistically true. According to the latest global wealth report, around 1 in every 140 adults on Earth now holds a net worth of over one million U.S. dollars. It’s a staggering figure, one that reshapes how we think about money, success, and what it means to be “rich” in the modern age.

Not too long ago, being a millionaire placed someone into an elite, almost unreachable class. It was the image of yachts, private jets, and exclusive clubs. Today, while those symbols still exist, the path to millionaire status has become more common, even routine for some. But that doesn’t mean it’s easy. It just means the global economy, especially in countries like the U.S., Australia, and Switzerland, has undergone a massive shift — and wealth creation is happening at a scale never seen before.

In fact, we’re living in what many economists are calling the largest wealth creation era in modern history. And it’s not just stock markets. Real estate, tech, entrepreneurship, crypto, and even generational inheritance have played key roles in pushing everyday individuals into millionaire territory. Think about it: someone who bought a modest house in California in the 1990s might now be sitting on over a million in equity. A tech worker with stock options? Same story. A millennial who started investing early in index funds? Also in the club.

Of course, not every country is experiencing this boom equally. The U.S. still dominates in terms of the absolute number of millionaires, with over 20 million adults holding that title. But in terms of millionaire concentration — or the share of the population that’s hit that milestone — countries like Switzerland and Australia actually lead. These places have relatively small populations but large shares of high-net-worth individuals, thanks to strong financial systems, stable economies, and booming property markets.

The shift also speaks volumes about how wealth is changing hands. We’re watching a transition as Baby Boomers — the wealthiest generation in history — begin to pass down their fortunes. The so-called “Great Wealth Transfer” is already underway, and it’s adding fuel to the millionaire fire. Younger generations, especially millennials and older Gen Z, are inheriting property, savings, stocks, and businesses at an unprecedented rate.

But while it’s easy to celebrate the rise of millionaires, it’s important to look deeper. Because underneath that shiny headline is a world that’s becoming more unequal. Yes, there are more millionaires — but there are also more people struggling to pay rent, save for retirement, or buy a home. In some places, inflation has canceled out income gains. In others, economic policies continue to favor those who already have assets. So while the millionaire club is expanding, the gap between the haves and have-nots is growing too.

Still, there’s something deeply symbolic about this new statistic. It challenges old beliefs about what’s possible. It makes financial independence feel more achievable. And for many, it reignites a dream that might’ve felt out of reach — the dream of not just surviving, but thriving.

Think of the people around you. Your neighbor. Your coworker. That quiet guy in your gym who drives a beat-up car. You might be surprised to learn some of them are millionaires on paper. Maybe they invested smartly, owned property early, or simply lived below their means and saved aggressively. The millionaire profile is shifting. It’s no longer just flashy entrepreneurs or Wall Street traders. It’s teachers, coders, freelancers, and even retirees who simply made the right moves at the right time.

That’s part of what makes this moment in history so unique. The path to wealth has diversified. There’s no single blueprint. Some built e-commerce stores. Others climbed the corporate ladder. Some just held index funds for 20 years. Some took big risks. Others stayed consistent and patient. The doors to wealth haven’t all been flung open, but they’ve definitely cracked wider than ever before.

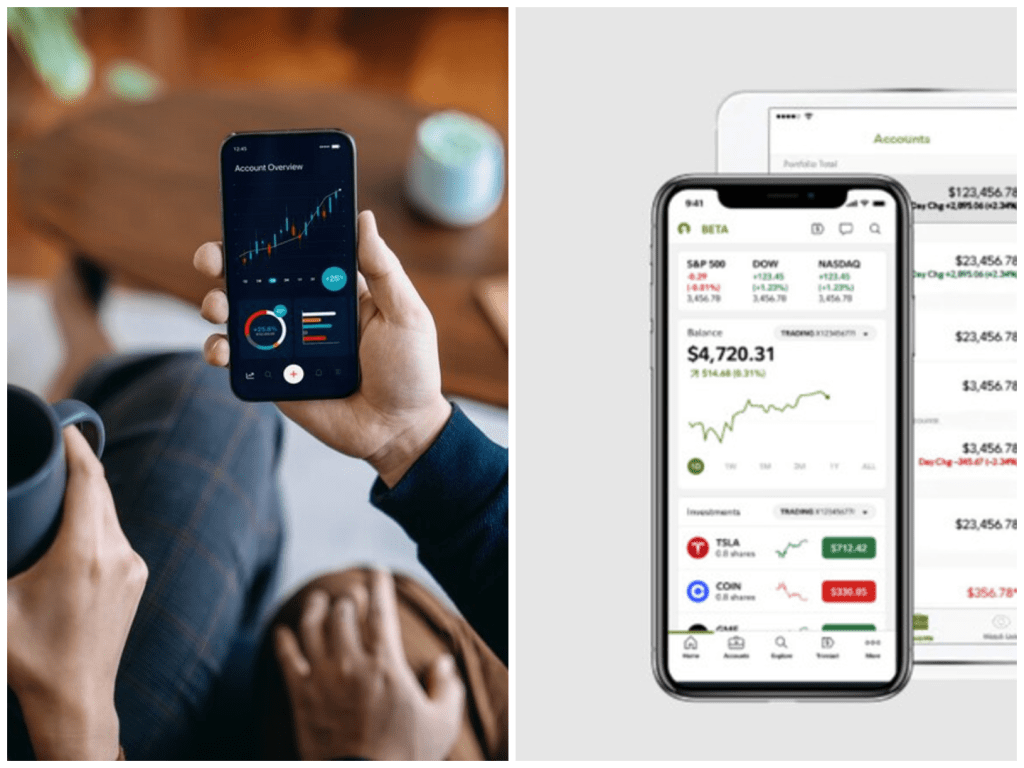

And while the world still wrestles with economic challenges — inflation, housing crises, debt — the momentum behind wealth creation continues. Governments are investing in new technologies. Young people are becoming more financially literate. The barriers to investing are lower than they’ve ever been. Apps let you start with $5. Knowledge that once belonged to Wall Street elites is now available for free on YouTube or TikTok. If you’re paying attention, the opportunities are there.

It’s also worth noting that while being a millionaire might not mean what it did 30 years ago — especially in cities where a million barely buys a small apartment — it still represents a major financial milestone. It means security. It means options. It means having the freedom to say no to a job, to help your family, or to chase a dream.

Of course, not everyone will get there. That’s just the truth. But the fact that 1 in 140 people has made it, and that more are on the way, tells a story of what’s possible. It’s a reminder that the world isn’t just moving fast — it’s moving in surprising, sometimes hopeful directions.

So what does this mean for you?

It means now is the time to pay attention. To learn. To save. To invest. To take smart risks. Because we’re living in an era where wealth is no longer just for the top 0.1%. More people are crossing the threshold than ever before — quietly, consistently, and in ways you might never expect. You don’t need to be born into money. You don’t need to invent the next iPhone. You just need to start.

And maybe, one day, someone will look at you and say, “Wow. You’re one of the 1 in 140.”